In financial markets, success is not driven by a single smart decision, it is shaped by every tool, every price feed, every click, and every subtle cost buried beneath the screen. Many traders work hard to build profitable strategies, only to watch their earnings leak away due to issues caused not by poor judgment, but by a poor trading partner. This is why choosing the right forex trading brokerage services becomes a decision that directly impacts personal wealth, trading confidence, and long-term growth.

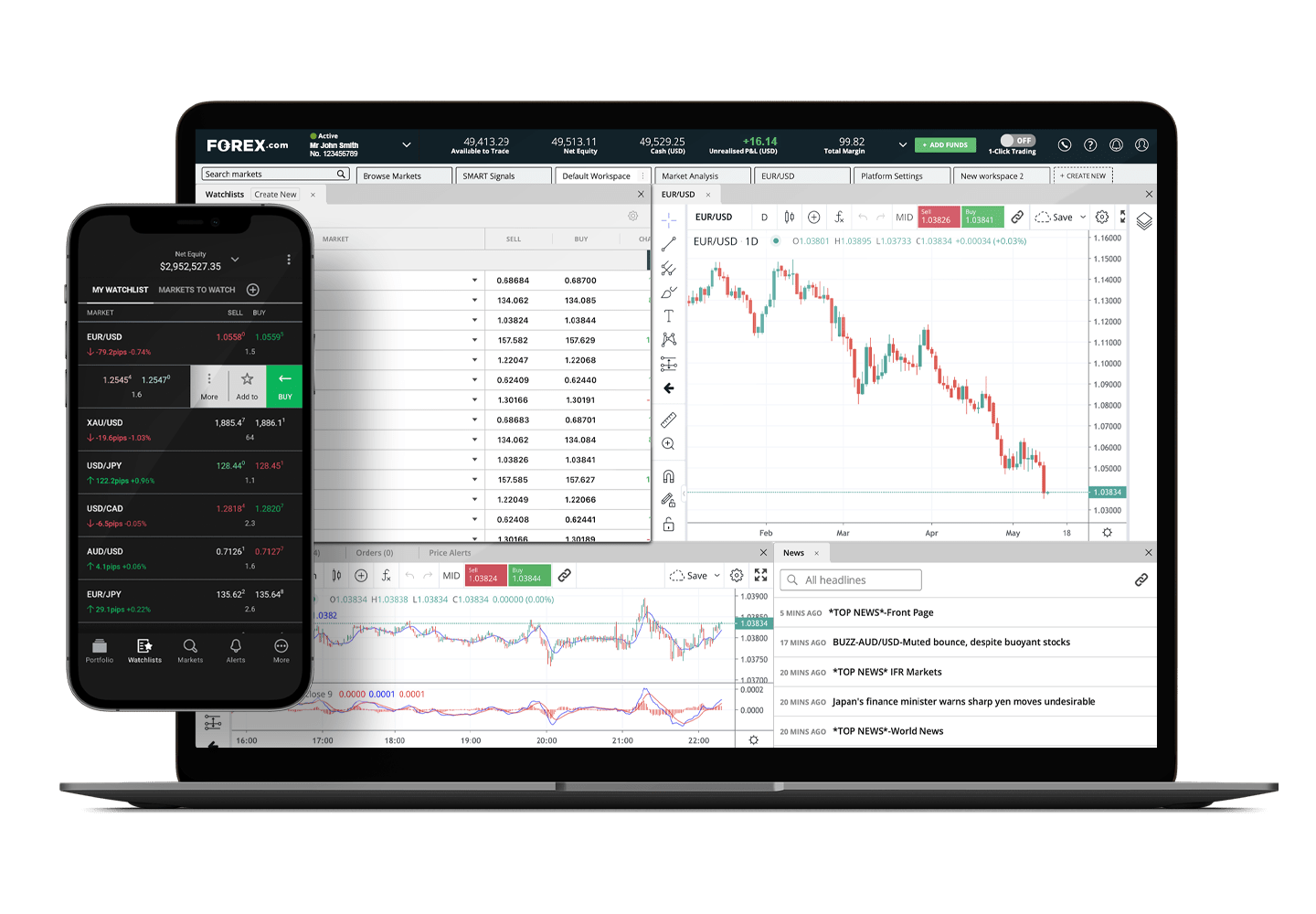

Trading platforms are not just digital interfaces; they are the bridge between opportunity and execution. They influence how fast you enter the market, how accurately prices display, and how much profit you actually take home. When this bridge is weak, even the smartest trader loses money.

The Silent Killers of Profit: What Bad Platforms Keep Hidden

Many struggling traders blame themselves. They assume they need more experience, better analysis, or deeper market knowledge. Yet, the real issue often hides inside the platform they trust with their money. If a trading partner manipulates spreads, provides slow order execution, or lacks liquidity depth, traders experience losses that have nothing to do with skill.

Let’s break down the key problems that quietly destroy profits.

1. Expensive Spreads That Steal Profit

Spreads, the difference between buying and selling prices are a basic trading cost, but sometimes they become a quiet trap. Some platforms intentionally widen spreads during volatile market conditions or at specific hours. This means:

- You start every trade with a bigger loss.

- Winning trades end up looking smaller than they should.

- Scalping and short-term strategies suffer severely.

For new traders who monitor only visible charges like commissions, these inflated spreads become invisible profit eaters. They assume they are not skilled enough, while the platform is silently draining their earnings.

2. Delayed Order Execution: The One-Second Disaster

Timing is everything in financial markets. Prices can change multiple times in a single second. A late execution affects the trade more than most beginners realize. With slow platforms:

- A good buy order becomes expensive by the time it executes.

- Stop-loss orders trigger too late, increasing loss.

- Fast market opportunities disappear instantly.

This delay is not just a technical flaw, it’s a risk. Reliable execution speed is a form of risk management. Real success requires not just the right trade idea, but the right moment of entry and exit. A platform that cannot handle execution pressure becomes a liability, not a trading tool.

3. Weak Connectivity and Insufficient Liquidity Access

Behind every trading platform lies a network of liquidity providers, banks, institutions, and major market participants who contribute real-time prices. When a platform has poor liquidity access, even the best forex day trading platform can fail to deliver accurate quotes or fair execution:

- Market prices do not reflect real conditions.

- Slippage increases, trades fill at unexpected prices.

- Spread manipulation becomes easier behind outdated price feeds.

Without strong market connectivity, traders operate in a distorted environment where the numbers on the screen do not match the real market. Accuracy is everything in trading; when prices are unreliable, strategies fail even if they are technically correct.

4. No Skill Support – Leaving Traders to Guess the Market

Even advanced traders rely on tools, data, and insights. A reliable platform should provide:

- A demo account to practice without loss

- Tutorials and education to guide traders

- Responsive support for technical and market-related questions

- Tools such as indicators, market news, economic calendars, and alerts

Platforms without support force traders to make decisions blindly. Guesswork becomes the default, and guessing has no place in financial markets. Many traders lose money not because they lack skill, but because they are not given the tools required to build it.

5. Unregulated or Weakly Regulated Brokers Put Funds at Risk

A platform may look advanced, offer huge bonuses, or promise high leverage but without strong regulatory oversight, traders expose themselves to serious financial risks. Unregulated or loosely governed brokers can:

- Freeze or delay withdrawals without justification

- Manipulate trade execution and spreads

- Disappear with client deposits during volatility or shutdowns

- Avoid accountability because no authority monitors them

Regulation acts like a financial safety net. A well-regulated broker follows strict compliance rules, segregates client funds, and maintains transparent policies. When traders ignore regulations, they risk not just losing trades, but losing their entire account.

6. Limited Withdrawal Options and Delayed Payouts

Trading profits only matter when you can actually access them. Weak platforms often complicate withdrawals by adding hidden fees, long processing times, or restrictive conditions. Many traders experience:

- Unnecessary verification delays after trading profitably

- Extra service charges for withdrawing funds

- Minimum withdrawal limits that trap smaller earnings

- Slow processing times that stretch from days to weeks

A reliable platform should offer fast, transparent, and hassle-free payouts. If a broker makes it difficult to withdraw your own money, it is a clear warning sign that the platform prioritizes profit over trust.

Conclusion

Choosing the right broker is not about hype, design, or advertisements. It is about protecting your capital from hidden fees, poor technology, and unreliable execution. A good platform does not just support trading, it safeguards profit, offers transparency, and teaches traders how to grow confidently.

For traders who value fast execution, transparent spreads, market depth, and reliable support backed by regulation, ANAX Capital Financial Markets LLC stands out as a trusted option in the UAE. With strong trading infrastructure, high liquidity access, and a commitment to transparency, it provides a secure and efficient environment for traders looking for the best forex day trading platform to build real financial growth.